Calculate instant tax without error through tax management software

No more worries during auditing, with zero miscalculation. Automated calculation made it easy

Trusted by over 20.000++ leading companies

More accurate and safer tax using tax management software

Mekari Jurnal offers comprehensive features that will ease managing your business taxes

Calculate tax more accurate with automated calculation

The most crucial thing in managing tax is calculating every tax object for all transactions

No need to worry you will underpay or overpay

-

- Minimize the risk so you won’t underpay or overpay the tax by automated calculation.

- No more hassle for tax bookkeeping with an instant tax object calculation for every transaction.

- Accurate with an automated calculation based on the type of tax object.

The manual calculation might result in inaccurate payment

-

- Miscalculation for tax payment can be a hassle when you have to deal with overpaid or underpaid tax.

- Need more effort to create a tax bookkeeping for company income tax report.

- A specialized team is needed to calculate the tax because every tax object has different ways to manage.

“I choose Mekari Jurnal because there is no need for installation and can be used anytime. Besides, Mekari Jurnal is integrated with tax to help a company create a tax report.”

Calculate tax without any risk of error with Mekari Jurnal

Eliminate the risk and unnecessary time with automated tax management software

Managing tax become faster and safer with Mekari Jurnal. Automated calculation and access through the cloud to ease your company’s tax process

Minimize the risk of insecurity and overdue documents when managing tax

-

- Record your tax instantly by importing tax invoices and return documents in a huge quantity.

- Minimize risk of late payment with automated calculation.

- Track tax documents instantly with tax archive features that are safely kept in the Mekari Jurnal system.

Offline safekeeping documents might result in leaked data

-

- Tax information has sensitive data that might leak if it is stored manually.

- There is a reforged risk due to data manipulation through fake tax invoices.

- Need a long time and high effort to track tax document that is stored separately.

“I choose Mekari Jurnal because there is no need for installation and can be used anytime. Besides, Mekari Jurnal is integrated with tax to help a company create a tax report.”

Manage tax documents with accuracy through Mekari Jurnal

No more worry and fluster to report tax manually

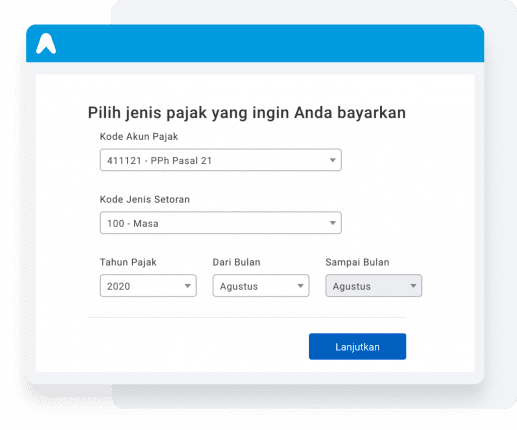

The manual process of tax payment that is long and complex can be shortened using Mekari Jurnal. You don’t need to install tax applications anymore

Manage your tax safely with the authorized partner of DJP

-

- Practical using one dashboard. From creating an official ID Billing to receiving the payment proof directly from DJP.

- Get a better overview with the tax archive feature to see unreported tax and reported tax.

- Analyze complete tax document real-time from e-filling, e-billing, e-faktur to e-bupot.

Piling up documents might result in a late tax report

-

- Complex tax report due to different unintegrated applications.

- Need extra effort to calculate tax based on the latest tax regulations.

- Tax document tracking took a long time due to being stored separately.

“I choose Mekari Jurnal because there is no need for installation and can be used anytime. Besides, Mekari Jurnal is integrated with tax to help a company create a tax report.”

Pay tax instantly with one click with Mekari Jurnal

We grow with several industries in Indonesia

Mekari Jurnal keep making innovation that makes it possible for us to fulfill every business need in each industry

Relish various benefits from reliable features

Enjoy the ease in managing online taxes with Mekari Jurnal

Tax reporting with KlikPajak

-

- Calculate tax automatically

- Automatic tax withholding

- Tax type matching based on the object

Automated calculation

-

- Manage invoices using the E-Faktur app

- Create official ID Billing from DJP

- Report your tax through eFiling

What is online tax software?

Online tax software is a program that is created to help a taxpayer in managing taxes such as Value-Added Tax, income tax, and final tax. Using online tax management software will help taxpayers manage taxes with ease, automatic and safe based on the DJP tax regulations.

Tax adherence for the taxpayer might feel hard to do, not because of the payment, but in terms of calculating and managing the taxes that might make the taxpayers feel overwhelmed.

This is the benefit of using online tax management software, it eases the works of the taxpayer.

Tax management features from Mekari Jurnal are integrated with an authorized partner of the Directorate General of Taxes.

Tax management from the automated calculation, tax payment, and reporting can be done directly from one app.

What is a tax?

Tax is a mandatory contribution from the citizen to the country and must be paid based on the regulations. Tax will be used to to the national development and other country expenses for the greater good for its people.

Tax adherence will help the nation to develop, therefore it will be beneficial to the taxpayer themselves.

There are a lot of taxpayers that disobey government regulations due to a lack of tax education and awareness. Besides the complication of the difficulty on how to calculate the tax, the government’s role in educating its people play a big role in increasing tax adherence.

What is the type of online tax management software in Indonesia?

Directorate General of Taxes released a feature for online tax solutions such as DJP online and the apps below:

- e-Registration: DJP information system that is used to manage the taxpayer’s online registration.

- e-Filling: reporting features for online SPT. Through Mekari Jurnal and KlikPajak integration, you can follow the steps easily.

- e-SPT: apps that can be used easily for the taxpayer to create electronic tax returns efficiently.

- e-Billing: app feature that can be used to pay tax online using given billing codes.

- e-Faktur: app feature that can be used to create electronic tax invoices in order to eliminate reforged tax invoices

- e-Bupot: app feature to create tax withholding slip for income tax 23/26. Mekari Jurnal is integrated with KlikPajak and has a lot of features that made the process more efficient and automated.

What is the benefit of using online tax software?

Tax management becomes easier, faster, and more accurate. Tax main features that are included in the Mekari Jurnal app are withholding tax report, income tax report, e-faktur for Value Added Tax.

What is the purpose of tax?

There are 4 purposes of tax, such as:

- Budgeting function: to do a national development including public facility service

- Managing function: to show the economic policies of a nation

- Stability function: to balance the nation’s economy in order to manage inflation or deflation

- Income redistribution function: to open a workplace therefore the citizens might have a spread income

How to download online tax software?

Mekari Jurnal offers a free trial app that is integrated with KlikPajak, download here for Android or iOS.

How to use online tax software?

After you download the online tax software, here are some guides to start using Mekari Jurnal integrated features to manage your tax.